business for sale topeka kansas

Search All ListingsFeatured ListingsSold ListingsHome Search Home EvaluationCalculatorsBuyingSelling Lifestyle Home ImprovementContact MeTestimonials For your convenience, we have set up several local custom searches here. ABR, GRI, ALHS (Accredited Luxury Home Specialist) 25yrs a real estate veteran as of 2016. There's not much I haven't done when it comes to real estate. I'm a life-long resident of Topeka, KS and I love it here!. I look forward to providing you and your clients, Ritz Carlton service! I also own WCW Property Management, Topeka's premier, professional property management firm. We can handle everything real estate, better than anyone! Jennifer Thomas - Licensed Realtor and Real Estate Assistant/ Transaction Coordinator, the Bill Welch Team. Christina Barth, Realtor, Buyer Specialist, the Bill Welch Team Call me: 785-260-5544 Cell, 785-273-9419 Office Welcome to Performance Realty, Inc., your source for Topeka real estate. If you own real estate that you're thinking of selling, I would be happy to provide you with a FREE Home Evaluation.

In today's competitive real estate market, timing is everything. Many good homes are sold before they are ever advertised. Beat other homebuyers to the hottest new homes for sale in Topeka with my New Listings Notification. Whether you are buying or selling a home, hire someone like me, who wants to earn your business. I invite you to contact me as I'd be happy to assist you with this important transaction. In addition, if you have any general questions about buying or selling real estate in Kansas, please contact me as I'm more than willing to help. Let me research and find a top Realtor for you in the area you're moving to. Only an experienced Realtor really knows what to look for in another great Realtor! Please browse my website for listings, reports and important local real estate information.You'll find over 400 new and used saddles in our store with all the tack you may need. We also carry cowboy hats, boots, and all the latest styles in western clothing and accessories.

If you're looking for a horse trailer....we have those too! So, come to the country to northeast Kansas' largest western store. We are just one mile east off K4 on 39th Street in Topeka, KS. 3256 NE 39th St. Monday 9:00 - 5:30 Tuesday 9:00 - 5:30 Wednesday 9:00 - 8:00 Thursday 9:00 - 5:30 Friday 9:00 - 5:30 Saturday 8:00 - 5:00 Click Edit Form to add form elements. You can enter a form description and instructions here. Home PageAbout usContact UsCalendarSitemapWe wrote this guide for online sellers who want to know if they even have to bother with sales tax in Kansas, and if so, how best to tackle the sales tax situation in the Sunflower State.You only have to begin thinking about Kansas sales tax if you have sales tax nexus in Kansas. “Sales tax nexus” is just a fancy way of saying “significant presence” in a state. Kansas considers a seller to have sales tax nexus in the state if you have any of the following in the state:

You can click here to read exactly what the Kansas Department of Revenue (Kansas’s taxing authority) has to say about what constitutes sales tax nexus in Kansas. If you sell on Amazon FBA, you may have sales tax nexus in Kansas. Storing physical products in a state can create sales tax nexus, and Kansas is home to at least one Amazon Fulfillment Center. To determine whether or not you have items stored in an FBA warehouse in Kansas, you can do one of two things: You may find that your inventory is stored in Kansas’s Amazon fulfillment center:

business for sale minehead Read here for more about Amazon and sales tax nexus.

business for sale yealmptonHere’s a list of all Amazon Fulfillment Centers in the country.

business for sale traverse city mi

You’ve probably read this far because you realized you have sales tax nexus in Kansas. Your next step is to determine if what you’re selling is even taxable. Services in Kansas are generally not taxable. So if you’re a photographer or a chef, you’re in luck and you don’t have to worry about sales tax. But watch out – if the service you provide includes installing, repairing, altering, or maintaining a product, you may have to deal with the sales tax on products. Tangible products are taxable in Kansas , with a few exceptions.

business for sale penzanceThese exceptions include computer software, meals and drinks, and construction materials.

home handyman services singapore So if you sell baskets, then charge sales tax to your Kansas customers.

business for sale alicante

But if you’re a chimney sweep, don’t charge sales tax to your Kansas customers. If you have sales tax nexus in Kansas and your products are taxable, your next step is to register for a sales tax permit. Sellers with sales tax nexus in Kansas must apply for a Kansas sales tax permit. Don’t skip this step! Many states consider it unlawful to collect sales tax in their name without a permit. Go here for more on how to register for a sales tax permit in Kansas . So you’ve determined that you have sales tax nexus in Kansas and what you’re selling is taxable.

mr handyman serviceAnd you’re all set and registered for your Kansas sales tax permit(s). The next step is to determine how much sales tax to collect. Sellers in Kansas should charge sales tax based on the buyer’s destination. /mobile on your mobile device. Example: You live and run your business in Topeka, KS 66409 which has a sales tax rate of 7.3%.

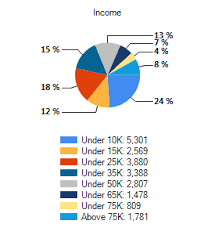

You sell to a customer in Kansas City, KS which has a sales tax rate of 8.77%. You would collect at the 8.77% rate. Sellers based out-of-state also charge sales tax based on the destination of the buyer. Example: You live in Nebraska, but have sales tax nexus in Kansas. You ship to a customer in Wichita, KS 67202 which has a sales tax rate of 9.15%. You would collect at the 9.15% rate. Whether your business is based in Kansas or outside of Kansas, if you sell on FBA and have sales tax nexus in Kansas you should collect sales tax at the rate of your buyer’s destination. If you are an Amazon pro seller and use Amazon to collect sales tax, be sure you have your sales tax settings set up correctly. Find step-by-step instructions for setting up your Amazon sales tax settings here. Shipping and handling are always taxable in Kansas, no matter whether the item shipped is taxable or not. Read a full explanation of sales tax on shipping in Kansas here. Top 20 Most Populous Cities in Kansas, with their sales tax rates

When you file and pay Kansas sales tax depends on two things: your assigned filing frequency and your state’s due dates. States assign you a filing frequency when you register for your sales tax permit. In most states, how often you file sales tax is based on the amount of sales tax you collect from buyers in the state. In Kansas, you will be required to file and remit sales tax either monthly, quarterly, or annually. How often you are required to file sales tax in Kansas follows this general rule: Kansas sales tax returns are almost always due the 25th day of the month following the reporting period. If the filing due date falls on a weekend or holiday, sales tax is generally due the next business day. Important to note: Very high volume Kansas sellers may be required to make monthly sales tax prepayments. In these cases, the first 15 days of the current month’s liability is due on or before the 25th of that month. You can read more about Kansas sales tax prepayments here.

*indicates a due date pushed back due to a weekend or holiday Click here for more info on Kansas sales tax filing due dates in 2017. When it comes time to file sales tax in Kansas you must do three things: We’ll walk you through these steps. Calculating how much sales tax you should remit to the state of Kansas is easy with TaxJar’s Kansas sales tax report. All you do is connect the channels through which you sell – including Amazon, eBay, Shopify, Square and more – and we’ll calculate exactly how much sales tax you collected. All the information you need to file your Kansas sales tax return will be waiting for you in TaxJar. All you have to do is login! You have two options for filing and paying your Kansas sales tax: There are a few more things you should know about sales tax in Kansas: Failure to File or Pay – 1% of tax due per month or fraction (maximum 24%). Other penalties for fraud or serial offenses include higher penalties and even criminal charges.